Breaking the Cycle of Racial Wealth Inequities and Higher Education Outcomes

Published May 2024

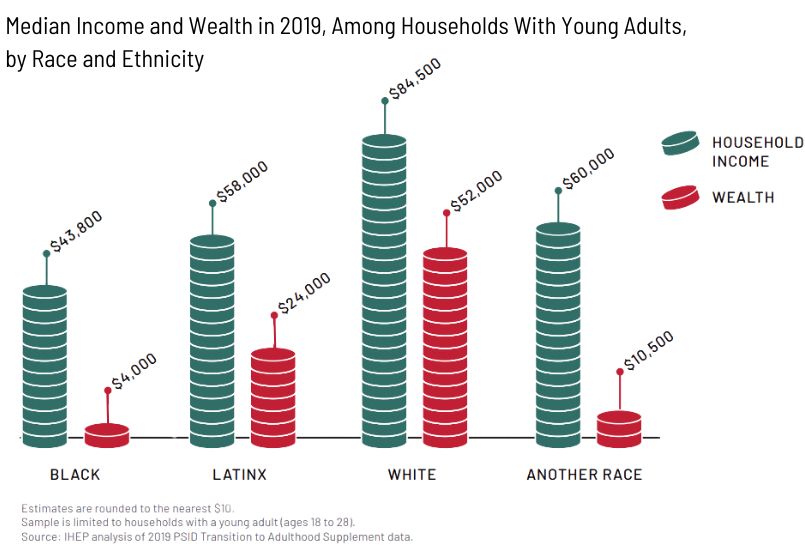

Wealth provides a more holistic measure of resources than income and plays a critical role in college access and success. While income disparities by race are significant, wealth disparities are even greater. For example, the median income for White households is nearly twice that of Black households, while the median wealth for White households is 13 times larger. This gap, which is rooted in generations of discrimination and systemic barriers to opportunity, affects the college dreams of countless people from historically marginalized communities.

How large is the racial wealth gap?

Data on wealth and higher education are limited, masking inequities and opportunities to promote better student outcomes. Breaking the Cycle assesses the availability and limitations of current data sources and proposes a framework for understanding the cyclical relationship between higher education and the racial wealth gap.

How is wealth associated with college savings, enrollment, completion, and borrowing?

Wealth has a profound impact on every stage of the college experience. Our analysis finds:

- Savings: Individuals who receive a wealth transfer of at least $10,000 from their parents or grandparents are nearly twice as likely to save for their children’s college education.

- Enrollment: While both income and wealth influence college enrollment rates, their impact varies significantly across racial and ethnic groups. Wealth is an especially salient factor for Latinx students, where differences in enrollment rates are more pronounced based on wealth rather than income, highlighting the need for targeted support mechanisms.

- Completion: Even among high-income and high-wealth Black and Latinx students significant disparities in completion rates persist, pointing to systemic barriers beyond financial resources.

- Borrowing: Students from different races and ethnicities do not borrow at the same rates. As their household wealth increases, White students are less likely to borrow, but this pattern does not necessarily hold true for other racial groups. Further research is needed to fully understand the factors contributing to these patterns.

How to break the cycle of racial wealth inequities and higher education outcomes?

The report outlines actionable recommendations for policymakers and researchers to dismantle these structural inequities and create a more just and equitable higher education system, including:

- Centering racial equity in policymaking, explicitly addressing inequities and historical causes that have perpetuated disparities in higher education outcomes.

- Considering how wealth should be incorporated into the disbursement of need-based financial aid, exploring new approaches that account for wealth data while minimizing unintended consequences.

- Designing recruitment, outreach, and admissions policies that increase access for students from low-wealth backgrounds, alongside those from low-income backgrounds.

- Identifying student support practices that specifically address completion disparities by wealth, ensuring that interventions are tailored to meet the needs of students from low-wealth backgrounds.

- Assessing and improving policies related to student loans to foster opportunities for wealth-building and reduce disparities in borrowing and repayment by race and ethnicity.

- Investing in historically underfunded institutions, such as historically Black colleges and universities (HBCUs) and minority-serving institutions (MSIs), to expand their capacity to serve students of color from low-wealth and low-income backgrounds.

Improvements to existing data sources would enable researchers to develop more robust metrics and conduct research that informs evidence-based policy solutions.

The report also calls for expansions and improvements to data sources to better understand the relationship between wealth and higher education and inform targeted inventions to promote equity. Many current datasets capture information on either higher education or wealth — not both. Recommendations include publishing wealth summaries from FAFSA submissions in publicly available datasets, adding median asset variables disaggregated by race and ethnicity to future releases of College Scorecard, collecting more granular data on wealth in longitudinal studies, and oversampling small populations to gather sufficient sample sizes.

Read more in the full report and executive summary.